Q: Is blockchain an inherently political technology? [Paid/Free #17]

The common perception is that technology is just a tool, with intent only prescribed at the point of usage. As modern tech disproves this notion, where does blockchain fit on the spectrum?

Well, hello there, my friends.

This has been an challenging week for me personally, for reasons beyond the scope of this newsletter, which nonetheless lead to a conversation with a friend on the issue of my continued involvement in this space.

My friend challenged whether my commitment to continue to champion cryptocurrency and blockchain technology in the face of extreme adversity was warranted, given that state-level clapback towards some bitcoiners is imminent.

“Maybe you should consider exiting the space, given what’s ahead?”

What’s clear is that Bitcoin is making very large strides towards mainstream adoption in a positive way, particularly in places like Central and South America. It’s also clear that the powers that be (including the US, China and some international organizations like the IMF) are using their considerable influence to quash cryptocurrency adoption within their spheres.

Alongside this, Web 3.0 (which to me includes the worlds of DeFi and NFTs and other features of Turing-Complete Blockchains) is seeing heretofore unseen levels of adoption. This seems much like the adoption cycle we saw with ICOs in the 2016-2019 period, and feels like we will soon see the SEC or other regulatory bodies start to turn their respective Eyes of Sauron towards this field of work.

Why, with the dread and adversity that is inevitably headed this way, why would anyone stick this out and identify publicly as a crypto and blockchain person?

Some folks will say the money, others will say the they’re “in it for the tech.”

Neither reasons quite resonate with me; when I asked myself what my reasons were today, I came to the conclusion that I’m in it for the politics.

What do I mean by that? More on that in the Deep Dive section.

Thanks for your support!

Thanks to an uptick in recent paid subscribers, I’m making this article, which relies very heavily on previous paid research we’ve published, for free. You’ll be able to read this entire post without going behind the paywall, but most of the links in the article will take you back behind the paywall!

As always for those who are, thank you for being a paying subscriber to my newsletter! Your support makes all this possible.

If you think you know someone who’d benefit from this issue, feel free to forward them this email!

If you’re someone who got this email via forward, use the following link to try us out for another two weeks, free!

As is appropriate for a newsletter on the topic, you’re able to purchase your subscription using a variety of cryptocurrencies, including Bitcoin!

And, of course, there’s this new thing we’re doing with art NFTs (read more, read more paid) where you can buy some cover art and own a lifetime subscription to the pub!

Blockchain Bulletin

Twitter gives out a set of 140 animated NFTs on its platform featuring seven designs. Social media platform Twitter gave away a set of seven NFTs, with 20 available in each design to people who replied to the announcement tweet of the giveaway, reported The Block.

Tim Berners-Lee sells web source code NFT for $5.4M. Father of the World Wide Web, Tim Berners-Lee sells source code for the WWW – along with other memorabilia and works -- as an NFT for $5.4 million at auction, reported the BBC.

Blockchain Behind the Scenes

Coinbase plans to develop decentralized app store using blockchain. Coinbase is planning to create a DeFi cryptocurrency app store to list legal assets that will exist on the blockchain and use smart contracts.

YouTube took down human rights videos, but they were backed up on blockchain. A human rights group that records testimonies of people whose families have vanished in China's Xinjiang region says YouTube removed their videos, but they backed up their media with Odysee.

Blockchain Deep Dive: Is Bitcoin an inherently Political Concept?

This is a long form editorial by me that summarizes the thrusts of a lot of my most popular lectures I’ve given as a conference keynote in the past.

Technical Analysis: Preparing your portfolio for a bear market

From VirtualBaconDAO’s Dennis Liu

Dennis provides insights on why he thinks ETH is in “bull trap mode” right now, and what downmarket coins may survive a bear market mostly intact.

Blockchain Bulletin

Twitter gives out a set of 140 animated NFTs on its platform featuring seven designs

The social medial platform gave out 140 NFTs to its users featuring seven different designs, The Block reported.

The non-fungible tokens are all short GIFs related to the Twitter platform in different ways, mostly strange animations and characters involving the platform’s brand.

Although Twitter gave out the NFTs itself on the platform, it posted them on the Rarible marketplace where some of them have bids for sale.

Examples include “Rare Form,” a holographic trading card with a Twitter-styled bird on it; “First Born,” a blue rotating package with an egg-shaped toy inside containing CEO Jack Dorsey’s first tweet; and so on.

Twitter handed out the NFTs directly to people who replied to its main tweet announcing the giveaway.

Although owners of the NFTs may display, trade and sell them, there are restrictions as to their use. Twitter maintains that NFT owners may not use the tokens with any product or service that is not a part of Twitter, or in a way that would tarnish its brand. Owners that violate these rules will be required to pay a fee of $100.

Tim Berners-Lee sells web source code NFT for $5.4M

The man credited as the creator of the World Wide Web, Sir Tim Berners-Lee, sold the original source code as a non-fungible token for $5.4 million through auction house Sotheby’s.

The BBC reported that the auction began on June 23 and the bidding began at $1,000. The highest bid reached $3.5 million for most of the last day, but a flurry of bids came in during the last 15 minutes that pushed it to its peak.

The sale does not give control of the copyright of the code, just bragging rights that they own the particular digital “collection” of files.

This collection consists of four particular files: time-stamped files of the source code, an animated video of the code being written, a letter from Tim Berners-Lee, and a digital poster of the code.

Blockchain Behind the Scenes

Coinbase plans to develop decentralized app store using blockchain

Cryptocurrency wallet and exchange Coinbase is planning to develop a cryptocurrency app store for decentralized apps that will exist on the blockchain and make use of smart contracts to do all the heavy lifting to represent legal assets, reported Pymnts.com.

“We’re seeing crypto quickly mature from its initial use case of trading bitcoin to the trading of thousands of new assets, and the adoption of new use cases like Decentralized Finance (DeFi), NFTs, smart contracts, Decentralized Autonomous Organizations (DAOs), and more,” Coinbase CEO Brian Armstrong said in a blog post.

Armstrong argues that it will be the best way to introduce new assets to the mainstream than before by providing a testing ground.

By delivering a DeFi app store directly through Coinbase, it will allow an “experimental” zone on the platform for these assets to exist. Right now, Coinbase takes a long time to onboard new cryptocurrencies -- as seen with how long it took the exchange to add Doge -- with a DeFi app store with vetted apps assets could be integrated more quickly.

YouTube took down Xinjiang videos, but they were backed up on blockchain

In an exclusive report, Reuters reported that a human rights group, Atajurt Kazakh Human Rights, credited by Human Rights Watch said that YouTube took down videos of testimonies from people who said that their families had disappeared in China’s Xinjiang region.

The group decided to move its videos onto the service Odysee, which is built on the LBRY blockchain, in order to protect it from potential censorship.

Reuters reported that the channel was blocked by YouTube’s automated system after twelve of its videos were taken down for guidelines breaches citing “cyberbullying and harassment.”

"They're just facts," Serikzhan Bilash, activist and co-founder of the group, said to Reuters. "The people giving the testimonies are talking about their loved ones."

Other videos received strikes because they displayed personally-identifying information. In this case, some videos do have IDs displayed so that people can prove that they are related to the families who have disappeared in the region. The group has been hesitant to blur the IDs because they believe it would jeopardize the trustworthiness of the videos.

YouTube told Reuters that it is working with Atajurt Kazakh to explain its policies and that the service makes exceptions for videos that are educational, documentary or scientific, but that the human rights group’s videos do not meet these requirements to a sufficient level.

These takedowns by YouTube have led the group to mirror the videos off YouTube and onto Odysee. As of the publishing of the article, the group had managed to move about 975 of its approximately 11,000 videos.

“We’re not afraid anymore, because we are backing ourselves up with LBRY,” Bilash said. “The most important thing is our material’s safety."

Blockchain Deep Dive: Is Blockchain an Inherently Political Technology?

I described in an early issue of this newsletter how I came to the field of cryptocurrency, and how I spent my early days exploring and learning about the space. In those days, I certainly identified with the ideals of what is now called Bitcoin Maximalism (a philosophy succinctly summarized by Ohio Congressman Warren Davis quipped during a hearing: “If it’s not Bitcoin, it’s a shitcoin.”).

In those days, though, it was less about which coin you were playing with as your main, and more about whether you were involved in creating tools that advanced cypherpunk principles.

These days, folks I like to call this path being “cypherpunk maximalists” (or as Brad Mills has been putting it: “Bitcoin Centrist.”).

There’s a lot of important work that needs to be done in the vein of work that Bitcoin is currently accomplishing that needs to also be accomplished using the tools of federation and decentralization, and honing your focus completely on a single coin (be it Bitcoin, Ethereum or anything else) to the exclusion of all others is extremely counterproductive to the causes that inspired this whole movement.

On the mailing list where Satoshi Nakamoto introduced the Bitcoin white paper, much earlier (on March 9th, 1993, to be exact), list member Eric Hughes penned something called the Cypherpunk Manifesto, a document that eloquently summarized a lot of the ethos of the group that inspired Bitcoin.

If you have five or ten minutes to spare and you’re reading this, it behooves you to spend some time reading that entire document.

If you can’t spare the time, here are some of my favorite quotes to pull, which I have used liberally in my lectures and presentations.

The opening phrases:

Privacy is necessary for an open society in the electronic age. Privacy is not secrecy. A private matter is something one doesn't want the whole world to know, but a secret matter is something one doesn't want anybody to know. Privacy is the power to selectively reveal oneself to the world.

The connection between speech and finance:

Since any information can be spoken of, we must ensure that we reveal as little as possible […] When my identity is revealed by the underlying mechanism of the transaction, I have no privacy. I cannot here selectively reveal myself; I must always reveal myself. Therefore, privacy in an open society requires anonymous transaction systems.

On Information:

Information does not just want to be free, it longs to be free. Information expands to fill the available storage space.

In it’s conclusion:

The Cypherpunks are actively engaged in making the networks safer for privacy. Let us proceed together apace.

Onward.

It, without incredible fanfare or superfluous description, described the very ethos at the heart of cryptocurrency and blockchain. I think this fanfare is sometimes missed by various coin Maximalism movements. I think, even more importantly, and in the context of the intro to this week’s letter, it speaks to the politics of the movement.

There’s no such thing as “neutral tooling.”

A very common thing to hear is that “technology is just a tool, which can be used for good or for evil.” That’s an aphorism that feels true when you’re talking about things like a hammer or a wrench, but gets stretched quite thin when you try to apply it to things like machine learning, social networking technology, and surveillance technology.

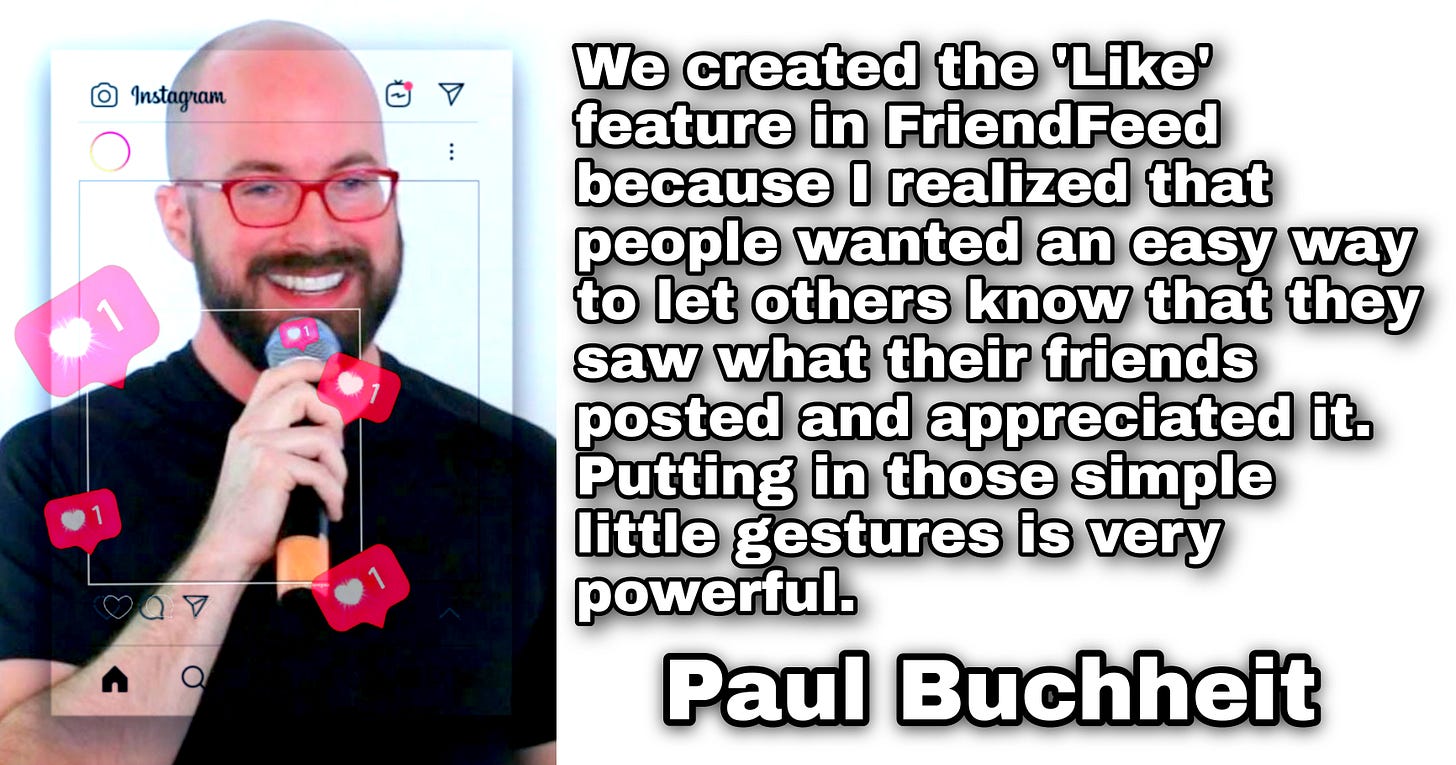

All of the things mentioned were very famously designed with the axiom in mind that tools are neutral things that can be used with ill or good intent. The truth of the matter is that tools like Facebook were designed with intent: to remove friction to engagement in all ways (a philosophy originally pioneered at early Web 2.0 social startup Friendfeed, but imported to Facebook by founders Paul Buchheit and Bret Taylor).

Reducing friction to engagement was the chief design principle and an intention for the network. You can debate the goodness or lack thereof with this principle, but the net effect certainly favors some types of speech over others.

At the time Twitter, Friendfeed and Facebook came to prominence was a time when longform blogging was the dominant means of hashing out political and technological ideals: a medium that is easier than print and broadcast media, but certainly more filled with friction than a 140-280 character tweet.

I don’t have to describe to you the net effect on our society to have all intellectualism distilled down to 240 character limit. It isn’t controversial or even partisan to suggest that this has pushed public discourse in a direction that favors propagandists, populists and those that thrive on an environment of disinformation. It’s a cross-border, cross-partisan phenomenon.

The more complex a tool is, seemingly, the easier it is to spot it’s faults which have arisen from the blind spots of its creators: from racist AIs, to fascist panopticoptic shopping services.

This is why, when considered in this vein, it isn’t simply the cypherpunk movement that has a political bent, but bitcoin and cryptocurrencies that trace their lineage to it, and the entirety of blockchain itself.

Blockchain is an inherently political concept.

If you’ve subscribed to this list and read more than a couple of issues, you’ve almost certainly read the following words before, my one sentence definition of Bitcoin: “Bitcoin is the reference architecture for blockchain, which is a decentralized internet protocol for removing or mitigating the requirement for trust between counterparties.”

Bitcoin was conceptualized in an environment that recognized the need for not necessarily anonymous transactions, but certainly private and self-sovereign transactions (which is just a fancy word for transactions that don’t require intermediaries, oversight or regulation).

The beauty of blockchain, as the world quickly realized in wake of it’s initial creation, is that a transaction doesn’t necessarily need to be rooted in financial aims. One of (if not the) very first forks of the Bitcoin code was something called NameCoin in 2010. It was a blockchain first posited by the late great Aaron Swartz.

NameCoin itself bore many of the same characteristics of Bitcoin itself, but instead its blockchain serving as a repository of just transaction data, it used it as well to store namespace data for the purposes of administering the namespace for the .bit top level domain.

The project continues to this day to serve as a working proof of concept of not only a functional alternative domain name system but many other key concepts used in other blockchains and cryptocurrencies.

Turing-Complete blockchains, to varying degrees, also solve a problem around not just information storage and retrieval, but processing, further democratizing the seemingly inscrutable services at the heart of the Web 2.0 and App revolution in computing.

As we’ve discussed, Turing-Complete blockchains gave rise to NFTs, which when looked at objectively are themselves world-changing in their potential, but still lack critical building blocks to utility, like a unified approach to identity.

When I say I believe this technology is world changing, I absolutely mean it.

There are one billion people globally (that is to say, 1/7th of the planet) who lack an ID card or standardized identity as we understand it in the West. Beyond that, there are about 1.7 billion people, or almost 2/7th of the world, who are unbanked. There’s an even larger number of people in the world who exist at the fringes of the identified populations who are for various reasons de-banked or de-identified (like sex workers, or migrant farm workers).

The promise of all the technologies above are truly amazing! We can potentially unlock the untapped promise, productivity and vitality of between one and three billion inhabitants of the planet with this technology.

So when people like my friend, who is without a doubt very well-meaning in her lecture on perseverance and it’s potential cost, tell me I should be working on something more meaningful than fintech to future of the planet, I bristle.

This is meaningful work! This will improve the planet and it’s citizens!

This is inherently political. This is designed with intention and purpose.

I cannot simply stop working towards this brighter future because the going is about to get tough. I’ve actively worked in this space as a researcher, maker, and journalist for a decade now, and I fully intend to continue to do so through the next decade.

Technical Analysis: Preparing your portfolio for a bear market

From VirtualBaconDAO’s Dennis Liu

Ethereum is up 20% or so over the past two weeks, but I still think there's a high chance that this is a bull trap instead of the start of a new rally. To analyze Ethereum, we have to look at its price denominated in Bitcoin instead of the dollar, because in the current uncertain market, the price of Ethereum is highly dependent on that of Bitcoins.

Because Ethereum fluctuates more in Bitcoin, so you're taking on more risk, we need to see it outperform Bitcoin in order for holding it to make sense.

The ETH/BTC chart has been respecting this long-term diagonal trendline since early 2019. Recently, we formed a double top followed by a breakdown below this trendline. This signals a downtrend. As long as ETH versus Bitcoin stays below the key level of 0.077, this is most likely a bull trap, and we are heading to much lower, around 0.04. But if we do get above 0.077, that means this is indeed a new uptrend. In that case, I will buy back my ETH.

Which coins can survive in a major bear market?

There are three criterias that I will look at, the market cap, the price history, and the use case of the coin. Starting off with Bitcoin and Ethereum, these are two obvious choices with the largest market cap and have gone through major bear markets and recover to a new all-time highs.

Going down the list, Binance Coin, Cardano, XRP, Litecoin, Chainlink, and Monero, these legacy coins also fit into the category. They have survived the major bear markets and have made a new all-time highs.

Similar to Cardona, we have Polkadot, Solana, and Cosmos.

Similar to Binance exchange, we have Crypto.com, FTT, and Uniswap. If Uniswap survives, other DeFi coins like Aave, Maker, Synthetix, Yearn, and SUSHI should also survive.

We have the NFT and gaming coins like THETA, Tezos, Chiliz, MANA, and Enjin. Bottom line is, all of these legit coins in the top 100 should survive a bear market, but the smaller the market cap, the more they would drop in a bear market.