Then they fight us, "hold my beer" edition. [86]

While I tapped out last week's editorial, the government decided that enough wasn't enough and needed to expand the war on innovation to new battlefronts. This week missive runs down the new list.

Last week, as I was typing the editorial entitled “and then they fight you,” the state around the world signalled their intent. It’s hard to imagine that while I was typingn all that out, the government was almost literally saying “hold my beer.”

Whenever all else fails to deter something, the state likes to deem something a “national security risk” in an effort to throw kitchen sink enforcement at it. The US Treasury has decided to do just that. The Treasury thinks that despite the US Dollar being a far more popular medium for crime, DeFi poses a bigger risk as terrorism financing, cybercrime, and money laundering.

Simultaneous to this, Congress continues to advance their “Tik Tok Ban,” which is written so broadly and overreaching that it can effectively be used as a kludge to ban anything the state wants to ban, up to and including any form of cryptocurrency, VPN, encryption or social media tool. Using apps that have been banned will earn you a fine of up to $1m, forfeiture of your personal assets, and up to 20 years in prison.

Under the proposed law, even educating someone on how to use privacy tools that have been deemed ‘unsafe’ can land you a $250k fine.

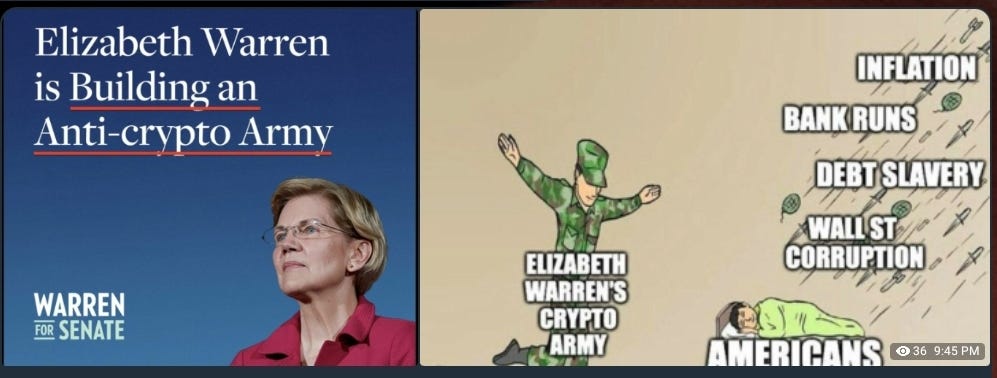

Just a week or so after Senator Elizabeth Warren debuted “building an anti-crypto army” as one of her campaign themes, she questioned crypto leaders in a hearing about their alleged role in the downfall of Silicon Valley Bank.

Warren and her fellow Senator Alexandria Ocasio-Cortez claim to be concerned about the risks posed to consumers and the broader financial system by the crypto industry's rapidly expanding lending and borrowing services. The senators have requested that Circle and BlockFi provide detailed information on their lending practices, interest rates, and customer protection measures. Circle and BlockFi have said that they will cooperate fully with the inquiry and are committed to complying with all regulatory requirements.

The lengths that the Senator Warren goes to in an effort to extricate the Federal Reserve from its own role in the collapse of SVB is pretty suspect for someone who claims to be a banking reformer. I'd question why it is she gives bankers such "white glove treatment."

Even in my home state of Texas, a bill that’s extremely harmful to US national interests in terms of cultivating innovation has emerged: SB 1751.

SB 1751 is a bill in the Texas Legislature that would require most bitcoin miners to register with ERCOT, prohibit them from using common property tax incentives, and limit their ability to act as controllable load resources. The bill is pork barrel fodder for industrial-scale energy users outside the mining industry, in an effort to tilt the playing field in their favor.

It wasn’t all bad news. Congressman Tom Emmer has accused the US Securities and Exchange Commission (SEC) Chairman, Gary Gensler, of being a "bad faith regulator." In an interview with Fox Business, Emmer criticized Gensler's approach to cryptocurrencies, saying he is pushing an overly regulatory agenda that could stifle innovation and hinder the growth of the industry. Emmer also accused Gensler of failing to clarify the SEC's position on several key issues, including the classification of cryptocurrencies, initial coin offerings (ICOs), and decentralized finance (DeFi). Emmer suggested that Gensler's views are "out of touch" with the crypto industry's needs and urged the SEC to work more collaboratively with lawmakers to develop balanced and sensible regulations.

I don’t see the ongoing focus of my newsletter to be strictly the regulatory pressure that the various forms of the state are applying towards crypto, but I will be covering it much more heavily when I see credible threats to the industry, as I have been for over a year.

It’s important even if you’re not strictly in the crypto and blockchain industry to pay attention. Many of these regulations and bits of legislation are being written broadly so as to apply to all sectors of innovation - and almost all of you who read this would be in an affected adjacent industry.

Thank you for your support!

If you enjoy this newsletter, you'll want to check these links out.

💛 - Send this email to a friend! Even if you’re on the paid version. It’ll get someone else interested, and possibly subscribed!

🖥️ - I’m now the producer and show-runner for the internet TV network “The Merge.” You can follow my work here, and go behind the scenes with me on Ryan Harper’s daily vlog.

🕊️ - I'm the Ops Pod lead for FreeRossDAO, a movement for prison reform and clemency for the unjust imprisonment of Ross Ulbricht. Learn more here, or subscribe to my FreeRossDAO Newsletter.

🤳 - Want more frequent updates? Join our Telegram channel and discussion group.

📧 - Did you get this emailed to you? Click here to try a premium subscription out free for 14-days (generally, two issues).

Blockchain Bulletin

Survey: Turns out 75% of crypto holders own NFTs. A CoinGecko and Blockchain Research lab survey reveals that about 75% of crypto holders own at least one NFT, which is probably not a surprise to anyone, reported Blockworks.

Japan approves Web3 white paper promoting crypto industry growth. Japan is working towards a more friendly environment for crypto as its ruling Liberal Democratic Party Web3 project team put forward a whitepaper suggesting numerous regulatory proposals to boost the country’s crypto industry, reported CoinDesk.

Blockchain Behind the Scenes

LayerZero raises mammoth $120M for cross-chain messaging protocol. The cross-chain messaging protocol developer LayerZero raised $120 million in new funding to make it easier for developers to build safe bridges for assets and apps that can interoperate between blockchains.

A copy of Satoshi Nakamoto’s Bitcoin whitepaper discovered hiding in MacOS. It appears that a copy of the original whitepaper outlining Bitcoin’s framework was discovered hiding out in modern versions of Apple’s Mac computers since Mojave.

Media Appearances This Week.

Keep reading with a 7-day free trial

Subscribe to Ask Doctor Bitcoin to keep reading this post and get 7 days of free access to the full post archives.